OUR SERVICES

WEALTH MANAGEMENT

Enhancing your Lifestyle for your Dreams to become Reality

WHAT WE DO

- Portfolio Construction/Reviews

- University/School Fees

- Inheritance Tax Planning

- Wealth Preservation

- Protection

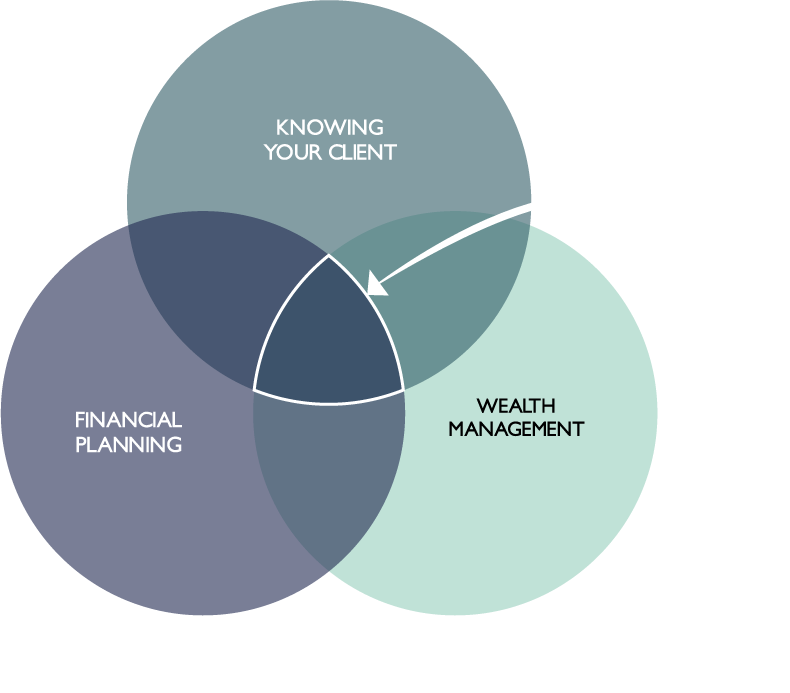

As a client of BWP, you are at the centre of our business. How we add value is by knowing our clients and then integrating Financial Planning and “in house” Wealth Management.

HOLISTIC APPROACH

ADDING VALUE

At each step in the process we aim to ADD VALUE by being consistent, efficient and coherent. We apply what we say.

Seeking our help from an Intergenerational Family Business is the best investment you can make:

- Providing you and your family with “peace of mind” and a sense of well-being.

- Saving time now and in the future for all generations

- Value for money

- Improve potential returns on your investments

- The best use of it in terms of their outcomes and the impact on their own ‘quality of life’.

Our holistic Financial Planning Advice aims to provide optimised flexible, recommended, regulated, suitable solutions to maximise all the resources available to cost effectively meet immediate and longer-term objectives with life enhancing outcomes.

The importance of forward planning helps articulate a “life plan” and determines goals and priorities which will benefit the whole family.

HOW DO WE

ADD ONGOING VALUE

OPTIMISED OUTCOMES

TRANSPARENT CHARGES

IMPORTANCE OF FORWARD PLANNING

ALIGNED RISK

TOTAL RETURN PHILOSOPHY

IMPROVED DECISION MAKING

ADD TAX EFFICIENCY

ENHANCED SPENDING STRATEGY

Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors. The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your initial investment. Where an investment involves exposure to a foreign currency, changes in rates of exchange may cause the value of the investment, and the income from it, to go up or down.